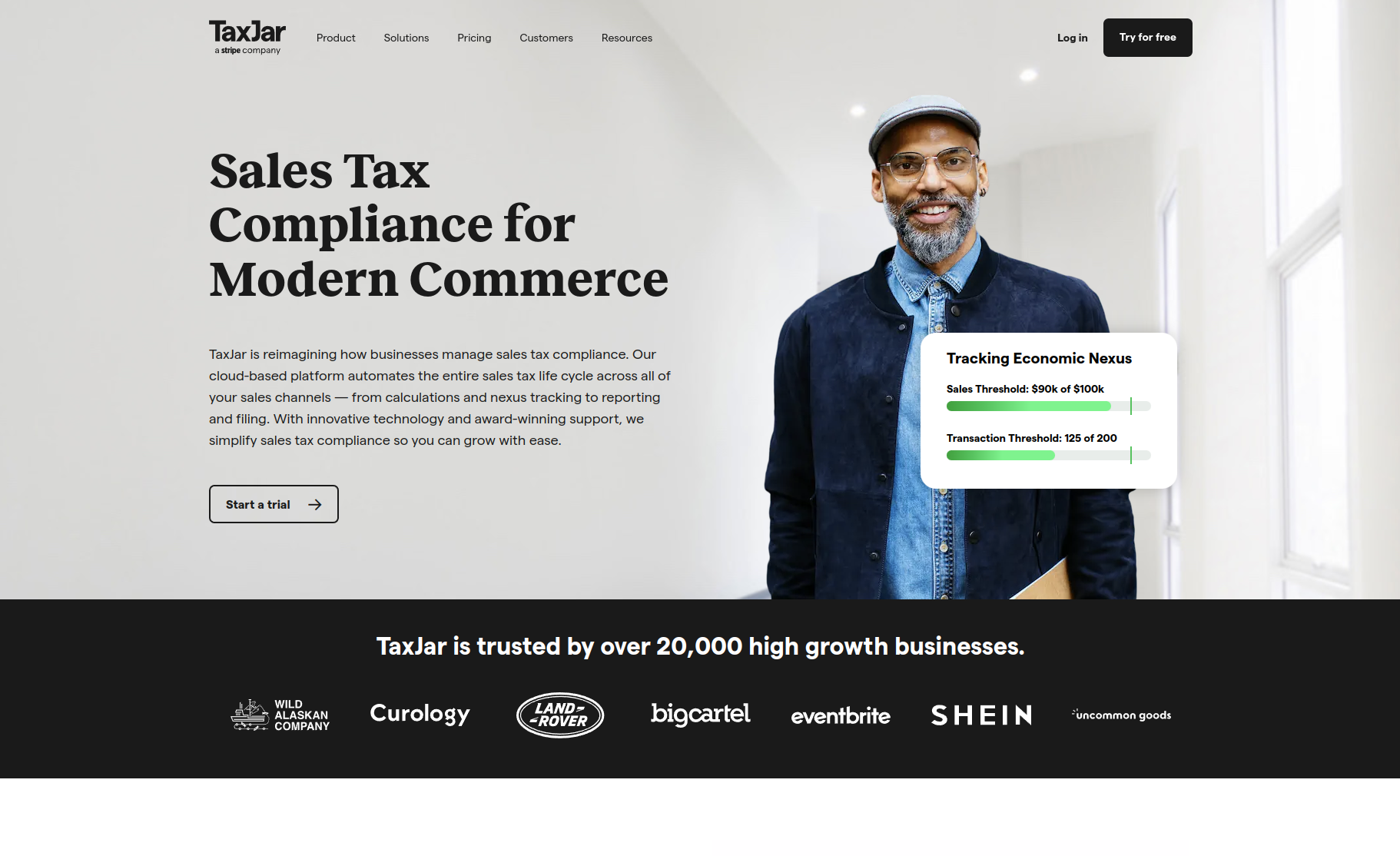

Sales tax compliance is a crucial aspect of running a successful business, especially for those operating across multiple channels. Managing sales tax can become quite complex due to varying tax rates and jurisdictional rules. TaxJar aims to simplify this process by offering a comprehensive solution for sales tax compliance.

This article will provide a detailed analysis of TaxJar, including its features, pricing, reviews, and alternatives.

What is TaxJar?

TaxJar is a cloud-based platform designed to streamline sales tax compliance for businesses of all sizes. It automates the entire sales tax life cycle, from calculations and nexus tracking to reporting and filing. This enables businesses to reduce the risk of errors, save time, and focus on growth.

TaxJar integrates seamlessly with various e-commerce and ERP platforms, such as Shopify, Amazon, and NetSuite. This makes it an ideal solution for businesses selling across multiple channels. By leveraging TaxJar’s powerful API, businesses can also create custom integrations, ensuring a smooth sales tax experience.

TaxJar Features

TaxJar offers a range of features and tools to simplify sales tax compliance. Some of these include:

- Sales tax calculations: TaxJar’s real-time calculation engine ensures accurate sales tax rates at checkout. It uses up-to-date rates and address validation to provide precise tax calculations, even during peak demand periods.

- Nexus tracking: With TaxJar, businesses can stay ahead of their economic nexus exposure by tracking sales and tax collection activities across 11,000 jurisdictions. This helps businesses identify when they have triggered a tax collection obligation and take appropriate action.

- Reporting and filing: TaxJar offers detailed reports on sales and sales tax collected or due by state and jurisdiction. Businesses can use these reports to file their returns and remittances accurately and on time.

- Multichannel support: TaxJar is designed to support businesses selling across multiple channels. It enables seamless expansion to new markets and simplifies sales tax compliance by aggregating transaction data from various platforms into a single report.

- AI-driven product categorization: TaxJar uses artificial intelligence to categorize products according to the appropriate tax rates. This helps businesses collect the correct sales tax on every product sold.

- Customer service: TaxJar is known for its award-winning customer service. The knowledgeable team is always ready to help businesses succeed, providing onboarding support, educational resources, and prompt assistance when needed.

Pros and cons of using TaxJar

Based on the reviews, the following are some pros and cons of using TaxJar:

Pros:

- Easy to use and set up, with a user-friendly interface

- Seamless integration with popular e-commerce and ERP platforms

- Accurate sales tax calculations and nexus tracking

- Time-saving reporting and filing features

- Excellent customer service and support

Cons:

- Some users report that the AutoFile feature is not available in all states

- Pricing may be higher than some alternatives

- Limited customization options for certain features

- Occasional technical glitches reported by users

- No phone support available

TaxJar Pricing

TaxJar offers a 30-day free trial, allowing businesses to test the platform before committing to a paid plan. Monthly and annual pricing options are available, with discounts for annual subscribers. Pricing is based on the number of transactions processed per month, with additional charges for AutoFile services.

TaxJar Reviews

Several users have praised TaxJar for its ease of use, efficient setup process, and accurate sales tax calculations. The platform’s ability to integrate with multiple marketplaces and combine transaction data into a single report has also been lauded.

However, some users have reported occasional technical issues and limitations with the AutoFile feature. Despite these minor drawbacks, TaxJar’s customer service has received consistently positive feedback for its responsiveness and helpfulness.

TaxJar Alternatives

There are several alternative sales tax compliance tools available, including:

- Avalara: A comprehensive sales tax compliance software that offers tax calculations, reporting, and filing services. Pricing is available upon request. Visit Avalara

- Vertex: A tax technology provider that offers solutions for sales tax compliance, including calculations, reporting, and filing. Pricing is available upon request. Visit Vertex

- Sovos: A global tax compliance software that provides sales tax calculations, reporting, and filing services. Pricing is available upon request. Visit Sovos

- CCH SureTax: A sales tax compliance solution that offers tax calculation, reporting, and filing services for businesses of all sizes. Pricing is available upon request. Visit CCH SureTax

Our Verdict

Based on the information provided, TaxJar is an excellent solution for businesses seeking to streamline their sales tax compliance. Its user-friendly interface, accurate calculations, and seamless integration with popular platforms make it an attractive choice for businesses of all sizes. However, some users may find the pricing to be higher than that of some alternatives.

While there are occasional technical issues and limitations with the AutoFile feature, TaxJar’s customer service is consistently praised for its responsiveness and support. Overall, TaxJar is a reliable and efficient sales tax compliance solution that can help businesses save time and reduce errors.

We encourage businesses to take advantage of the 30-day free trial and explore other alternatives to find the best solution for their specific needs.

Conclusion

In summary, TaxJar offers a comprehensive and reliable solution for sales tax compliance, with easy integration, accurate calculations, and excellent customer support. However, some users may find the pricing higher than that of some alternatives, and there are occasional technical issues.

We recommend TaxJar for businesses selling across multiple channels and seeking an easy-to-use solution for managing sales tax compliance. The 30-day free trial is a great way to test the platform and determine if it is the right fit for your business. Additionally, exploring other alternatives such as Avalara, Vertex, Sovos, and CCH SureTax can help businesses find the best solution for their specific needs.